We are about to be propelled into a global economy with a Synthetic Hegemonic Currency (SHC). In Part 2 of this two-part investigation, we will define the SHC and explore how we have been moved inexorably toward its imminent rollout.

In Part 1 we discussed the idea of a Synthetic Hegemonic Currency (SHC), first presented by then-Governor of the Bank of England Mark Carney at the G7 central bankers symposium at Jackson Hole, Wyoming, in August 2019. The ultimate objective, outlined by Carney, was to “end the malign neglect of the IMFS [International Monetary and Financial System] and build a system worthy of the diverse, multi-polar global economy that is emerging.”

We discussed how, following the financial crisis in 2008, the global debt-based monetary system was precipitously close to collapse. In response, the central banks “bailed out” crippled financial institutions by buying their toxic assets, thereby expanding central bank balance sheets. This was an apparent sticking plaster to hold the monetary system together in the short-to-medium term.

In subsequent years, successive central bank monetary policy decisions had the consistent effect of transferring wealth from the “real economy”—the economic activity we citizens engage in every day—to the financial markets, where the primary beneficiaries are global investors. Later the central bankers would maintain that their monetary policy moves were merely “mistakes”—an odd explanation, considering these moves all produced the same outcome worldwide.

Specifically, they claimed that their 2009 commitment to an unprecedented expansion of the monetary base—so-called Quantitative Easing (QE)—had “unforeseen” consequences. In truth, the QE model they chose to implement was a perfect—and apparently deliberate—inversion of Professor Richard Werner’s original design and intention.

The coordinated government fiscal policy did not follow Werner’s recommendation either. While the central bankers’ QE inevitably increased budget deficits and national debt. Government fiscal policy, far from stimulating the “real economy,” stifled economic activity.

At Jackson Hole in 2019, the global financial giant BlackRock presented its plan for “going direct.” This marked a significant change in the central bankers’ by-then-decade-old QE monetary policy.

Prior to going direct, expansion of the monetary base did not lead to a corresponding increase in commercial bank deposits. But after “going direct,” commercial bank deposits—containing “broad money”—were swollen as a direct result of central bank “base money” expansion. BlackRock referred to this as putting “central bank money directly in the hands of public and private sector spenders.”

The resultant inflation that existed pre-going direct had been masked for many years because it occurred almost exclusively in the financial markets. But going direct changed this, as the central bankers knew it would. The central bank’s balance sheets, loaded with toxic assets, started “leaking” into the real economy.

Once price inflation emerged in the real economy, the central bankers blamed global events, such as the pseudopandemic and the war in Ukraine, and raised the base rate in response. They called this move “Quantitative Tightening” (QT). Unsurprisingly, QT has significantly increased pressures in the global banking system and has further restricted government fiscal support for the “real economy.”

A clear pattern has emerged since the 2008 financial crash. Every central bank monetary policy and reactive government fiscal policy, though allegedly aiming to provide “an additional boost to the economy,” has only served to increase economic “stress and uncertainty” and enrich the financial superclass. It is hard not to conclude that the conditions for the introduction of a Synthetic Hegemonic Currency (SHC) did not simply “happen” but rather were engineered. And when we look at more recent and current events, our suspicion only deepens.

The Rationale for a Synthetic Hegemonic Currency (SHC)

Having presided over the QE monetary policy wealth transfer of the Bank of England, at the Jackson Hole conference Carney said that “we [central bankers] need to change the game.” He then suggested how the game should be changed. In Part 1, we noted him saying:

“There should be no illusions that the IMFS [International Monetary and Financial System] can be reformed overnight or that market forces are likely to force a rapid switch of reserve assets. [. . .] When change comes, it shouldn’t be to swap one currency hegemon for another. Any unipolar system is unsuited to a multi-polar world. We would do well to think through every opportunity, including those presented by new technologies, to create a more balanced and effective system.”

It is crucial to appreciate the G7 bankers’ objective. They desired a “multipolar” global economy and sought to “change” the IMFS to facilitate “a more balanced and effective [monetary] system” that would, according to Carney, assist with development of a “new world order.” At the same time, they understood that market forces alone, if left unchecked, would not deliver the significant change required.

The central bankers and investment managers like BlackRock considered the disproportionate impact of the US dollar (USD) to be an obstacle to achieving their ambitions. They also recognised that the reliance of global markets on the USD meant that a “rapid switch of reserve assets” was unlikely, absent some sort of intervention that would “change the game.”

Cross-border spillovers, or “externalities,” are the actions and events occurring in one country that have intended or unintended consequences in others. When global trade is impacted, this can also have a reciprocal effect on the trade balance and economy of nations that initiated the “spillover.” The reciprocal effect is often referred to as “spillback.”

Carney and the other bankers recognised that the increasingly interconnected nature of global trade and financial flows meant that cross-border spillovers could change the financial and economic conditions globally. A new multipolar IMFS and world economy, with more regionalised markets and shorter supply chains, would limit the spillover and spillback risks.

The threat of spillover inherent in the current IMFS threatened a global liquidity trap. The concern was that investors and foreign governments would hoard USD reserves, further slowing economic activity and growth.

Given the widespread dominance of the USD in cross-border claims, it is not surprising that any developments in the US economy, by affecting the USD exchange rate, can have large spillover effects on world asset markets.

Carney highlighted the “sticky” problem of the USD and the subsequent “spillover” and “spillback” risk. He explained how Emerging Market Economies (EMEs), such as Brazil, Russia, India, China, and South Africa (BRICS), were forced to trade and price assets in the USD. He then described why this presented a problem for corporations looking to capitalise on those “emerging” markets.

Carney also explained that fluctuations of the USD, often driven more by politics than economic logic, presented “unhedged” risks—risks that cannot be mitigated—to the multinational companies operating in EMEs, stifling global investment opportunities. As he put it:

“Movements in the US dollar significantly affect the real burden of debt for those companies (especially in EMEs) that have borrowed unhedged in dollars, and tend to reduce the dollar value of companies’ collateral. [. . .] Fluctuations in the dollar also significantly affect the risk appetite of global investors.”

This was an intolerable situation for the G7 central bankers. All the projected growth was in EMEs, not in the defunct, debt-saturated economies of developed nations. Therefore, spillback from developing economies needed to be restricted in order for prospective multipolar investment firms, such as BlackRock and Vanguard, to thrive in EMEs. To quote Carney:

“With EMEs projected to account for three quarters of the global economy by 2030, these spillbacks will only continue to grow. [. . .] [F]or EMEs, all else is not equal [. . .] because of the consequences of the growing asymmetry between the importance of the US dollar in the global financial system and the increasingly multi-polar nature of global economic activity.”

The equilibrium interest rate is the optimal interest rate, which supposedly determines the money supply. It is generally expressed as the rate point at which the quantity of money demanded is equal to the quantity of money supplied.

As previously discussed, the G7 flooded the global economy with virtually free money for more than a decade, increasing the supply of money far beyond demand in the “real economy.” They exacerbated this over-supply problem post-going direct. One of the known consequences of this strategy is a liquidity trap.

Ironically, Carney identified the equilibrium interest rate as a further impediment to central bankers’ ability to “change the game” to their liking:

“Past instances of very low rates have tended to coincide with high risk events such as wars, financial crises, and breaks in the monetary regime. Whether the last happens is still within our control, but for now the lower global equilibrium interest rate is reducing monetary policy makers’ scope to cut policy rates in response to adverse shocks to demand, and increasing the risk of a global liquidity trap. And left unattended, these vulnerabilities are only likely to intensify.”

Carney didn’t acknowledge that central banks had foregone all concerns about the global equilibrium interest rate and had rushed headlong into a global liquidity trap. He also brushed over the inter-dependency of “high risk events” and “low [equilibrium] rates.”

The cavalier monetary policy that had pushed the IMFS toward collapse in 2019 was, in part, a rate response to a “high risk event.” Equally, the central bankers’ virtual money printing threatened to cause another “high risk event.”

With an eye set on breaking the “monetary regime,” the conventional monetary policy lever of adjusting the equilibrium rate was exhausted. Hence the attractiveness of the unconventional monetary policy of “going direct” QE and the even more unconventional policy of constructing an SHC.

In order to truly “change the game,” a concerted effort was required to rid the world of the old unipolar IMFS and construct the new multipolar model:

“The IMFS is not only making it harder to achieve price and financial stability but it is also encouraging protectionist and populist policies which are exacerbating the situation. [. . .] Those at the core of the IMFS need to incorporate spillovers and spill backs, as the Fed has been doing. More broadly, central banks need to develop a better shared understanding of the scale of global risks and a recognition that concerted, cooperative action may sometimes be necessary.”

The objective of the central bankers’ “concerted, cooperative action” could not have been clearer:

“In the new world order, a reliance on keeping one’s house in order is no longer sufficient. The neighbourhood too must change. [. . .] We are all responsible for fixing the fault lines in the system. [. . .] ultimately a multi-polar global economy requires a new IMFS to realise its full potential.”

Evoking Schumpeter’s “creative destruction,” the need to remodel the Western debt-based IMFS was pressing. As Carney emphasised, the “centre won’t hold.” In Carney’s estimation, potential reserve currency challengers were not ready “to create a more balanced and effective system”:

“The most likely candidate for true reserve currency status, the Renminbi (RMB), has a long way to go before it is ready to assume the mantle.”

Something else would be required to finally end the old IMFS and establish the new version, suitable for the sought-after multipolar global economy. A Synthetic Hegemonic Currency (SHC) was the suggested solution:

“While the rise of the Renminbi may over time provide a second best solution to the current problems with the IMFS, first best would be to build a multipolar system. [. . .] While the likelihood of a multipolar IMFS might seem distant at present, technological developments provide the potential for such a world to emerge. Such a platform would be based on the virtual rather than the physical. [. . .] It is an open question whether such a new Synthetic Hegemonic Currency (SHC) would be best provided by the public sector, perhaps through a network of central bank digital currencies.”

It is notable that a system of competing “conventional” reserve currencies was considered the “second best solution.” The new multipolar IMFS, constructed using an SHC, was preferable because it negated the need for any legacy connection to the old system: a completely new IMFS and a global economy fit for the multipolar world order.

The G7 bankers no longer consider the USD to be “safe” or, more accurately, “useful.” According to Carney, an SHC had a number of advantages:

“[A]n SHC in the IMFS could support better global outcomes, given the scale of the challenges of the current IMFS and the risks in transition to a new hegemonic reserve currency like the Renminbi. An SHC could dampen the domineering influence of the US dollar on global trade. If the share of trade invoiced in SHC were to rise, shocks in the US would have less potent spillovers [. . .], global trade would become more sensitive to changes in conditions in the countries of the other currencies in the basket backing the SHC. The dollar’s influence on global financial conditions could similarly decline if a financial architecture developed around the new SHC and it displaced the dollar’s dominance in credit markets. By reducing the influence of the US on the global financial cycle, this would help reduce the volatility of capital flows to EMEs. Widespread use of the SHC in international trade and finance would imply that the currencies that compose its basket could gradually be seen as reliable reserve assets, encouraging EMEs to diversify their holdings of safe assets away from the dollar.”

To recap: In 2019, the G7 central bankers wanted to diminish the role of the USD because spillover and spillback was hampering investment finance opportunities in EMEs. EMEs were where the projected growth lay, and the current debt-based IMFS was too unipolar and unsuited to this purpose. Reserve currencies somehow needed to be “re-balanced” to facilitate a new multipolar IMFS.

Possible EME alternative reserves, such as China’s RMB, were not ready and, even if they were, were unlikely to inspire the necessary investor confidence. Therefore, a Synthetic Hegemonic Currency (SHC) was the best possible solution, according to the G7 central bankers.

To be precise: An SHC is a network of central bank digital currencies [CBDCs] pooled into a basket of currencies. The SHC will underpin the IMFS of a new multipolar global economy. The ultimate aim is to have a global SHC. The global SHC will be a worldwide network of CBDCs, linking numerous baskets together.

The Intangible SHC

It is unlikely that we will ever hear the term “Synthetic Hegemonic Currency” discussed again. It is a public relations nightmare. But it is sufficient to know what an SHC is to recognise it when it arrives. There are, however, some caveats.

It is entirely possible that CBDCs could be disguised. Broadly speaking, CBDC can either be “wholesale” or “retail.” Wholesale CBDC is similar to the central bank reserves that commercial banks and financial institutions use to settle payments between each other. The public does not have access to central bank reserves and equally would not be able to use wholesale CBDC.

Retail CBDC is offered as a liquid alternative to cash. It is available to the public and it is retail CBDC that we would use in the “real economy.”

The favoured model for the deployment of CBDC is the “two-tiered” or “hybrid” model. The digital pound and the digital ruble, India’s e-Rupee, China’s e-CNY and Nigeria’s eNaira are all examples of CBDC distributed on two-tiers. They enable settlement between financial institutions to be conducted in wholesale CBDC while simultaneously allowing private commercial banks and payment providers the freedom to develop a range of financial products and services that may appear, from the “users” perspective, unrelated to CBDC.

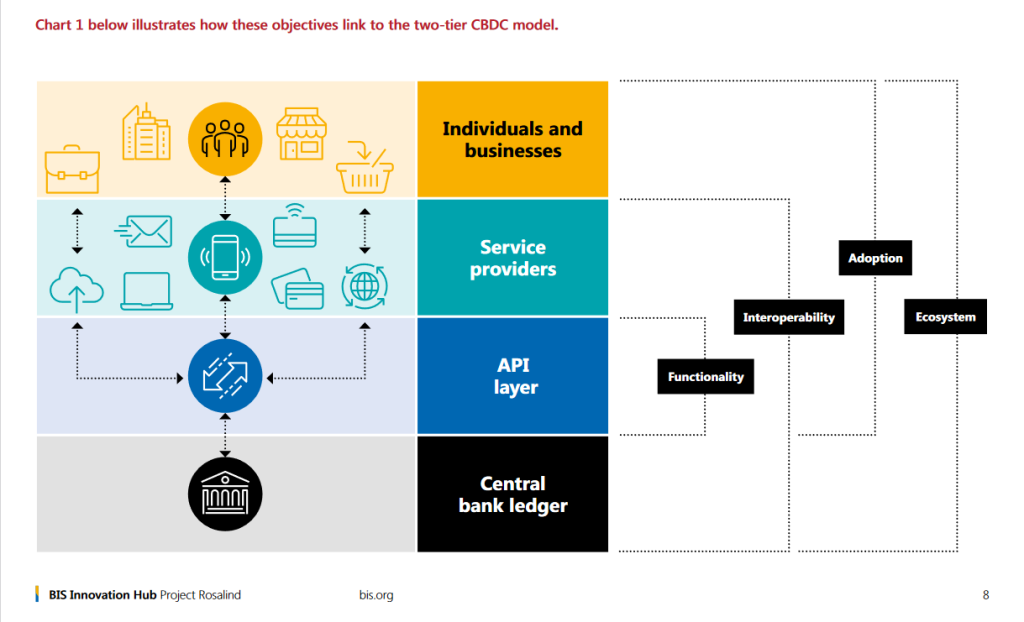

In its technical specifications for the digital pound the Bank of England (BoE) explained how the two-tiered CBDC functions:

“The [two-tier] platform model is currently the preferred model for offering a UK CBDC. [. . .] The Bank hosts the core ledger and an application programming interface (API) layer. The API layer would allow private sector firms, known as Payment Interface Providers (PIPs) and External Service Interface Providers (ESIPs), access to the core ledger functionality in order to provide user services. [The] ledger records updates to the state and ownership of tokens or the destruction and creation of unique tokens. [. . .] Technologies for a CBDC are also relevant to privately issued digital money, like stablecoins. [. . .] PIPs could implement some [. . .] features, such as automated payments and programmable wallets, by hosting the programmable logic, and updating the core ledger with the result via the API.”

Private financial institutions—PIPs and ESIPs in the UK, for example—can develop all manner of digital products, such as stablecoins, non-fungible-tokens (NFTs) or digital tokens, that operate on the CBDC API layer.

Recently JPMorgan outlined its plan to offer the public “deposit tokens”:

“Deposit tokens refer to transferable tokens issued on a blockchain by a licensed depository institution which evidence a deposit claim against the issuer. [. . .] The token form enables new functionality, such as programmability. [. . .] Deposit tokens also operate as a realistic alternative to stablecoins, on both public and permissioned blockchain environments. [. . .] The ability for banks to settle their deposit token exposure to other banks in central bank money [. . .] alongside a clear path to interoperability with existing payment infrastructures when redeeming these deposit tokens, should support the singleness of the currency. Such a two-tiered system has the added benefit of preserving the important role that central banks play in wholesale settlement today. Real time methods to settle central bank funds, such as by using a blockchain based CBDC, may actually strengthen the current system.”

Digital payment “products” such as JPMorgan’s deposit tokens can, and almost certainly will, utilise the two-tiered CBDC API layer. Just like retail CBDC, they offer the potential for “programmability” and, via Fast Payment System (FPS), real time cross-border settlement.

From the public’s perspective, such digital products are liquid assets that serve as a “cash” alternatives. If they sit within the two-tiered CBDC infrastructure they will be CBDC in all but name. Thus, raising the potential for people to be enticed to adopt CBDC unwittingly.

Consequently, spotting the SHC when it arrives will rely upon an appreciation of the underlying technology used by the various digital payment products and services we are offered. There is every chance that the commercial banks won’t acknowledge that their digital products and services effectively constitute retail CBDC. From the perspective of those who seek to control the global multipolar IMFS, these “two-tier” based commercial monetary products and services will maintain the “singleness of the currency.” What appears to be a network of “decentralised” private coins and tokens will actually be components of a centrally controlled SHC.

Mark Carney: Among the Few Who Can Push the Synthetic Hegemonic Currency

It is tempting to dismiss plans for an SHC as the wishful thinking of a powerful man and his international partners. However, it’s too late to dismiss it. In 2023, the SHC suggested by Carney is already under construction and is very close to being implemented.

A regional SHC is currently being formulated by the BRICS+ group of nations and “the” global SHC is gradually being pieced together. We are one global financial crash away from the SHC-based multipolar global economy. High-risk events have been known to break monetary regimes.

Is it just a coincidence that monetary and fiscal policy since 2008 has weakened the “real economy” to such an extent that a high-risk financial event is all but inevitable? Just as post-2008 monetary policy and fiscal policy combined to create the conditions to supposedly warrant an SHC, so global events and the policy response to them, post-Carney’s SHC speech, have also advanced SHC prospects significantly.

Before we explore this subject further, it is worth noting that Mark Carney is no ordinary central banker. Whether welcome or not, his words carry more weight than most.

Following a highly lucrative thirteen–year career as an investment banker with Goldman Sachs [1995–2008], Carney has been the governor of two central banks—Bank of Canada and Bank of England. He is also a member of the influential Group of 30 (G30). He was chair of the Bank for International Settlements (BIS)-hosted Financial Stability Board. He also chaired the Global Economy Meeting and Economic Consultative Committee of the BIS.

In addition, he is a former member of the World Economic Forum (WEF) Board of Trustees, the current United Nations Special Envoy on Climate Action and Finance, and the co-chair of the Glasgow Financial Alliance for Net Zero (GFANZ).

Carney is also a member of numerous influential globalist think tanks, including the Royal Institute of International Affairs (Chatham House), where he is a senior advisor. The organization lists some of his many other roles and financial business interests:

“Mark Carney is a vice chair of Brookfield Asset Management and head of ESG and impact fund investing. [. . .] He is also an external member of the Board of Stripe, [. . .] a member of the global advisory board of PIMCO, [. . .] the Harvard Board of Overseers, Oxford Blavatnik School of Government, the boards of Bloomberg Philanthropies, the Peterson Institute for International Economics, and the Hoffman Institute for Global Business and Society at INSEAD. He is also chair of the global advisory board and senior counsellor of the Macro Advisory Partners, and chair of the advisory board with Canada 2020.”

It is notable that Carney is instrumental in creating global sustainable development debt slavery. He is part of the financial clique that controls global monetary policy and investment risk ratings.

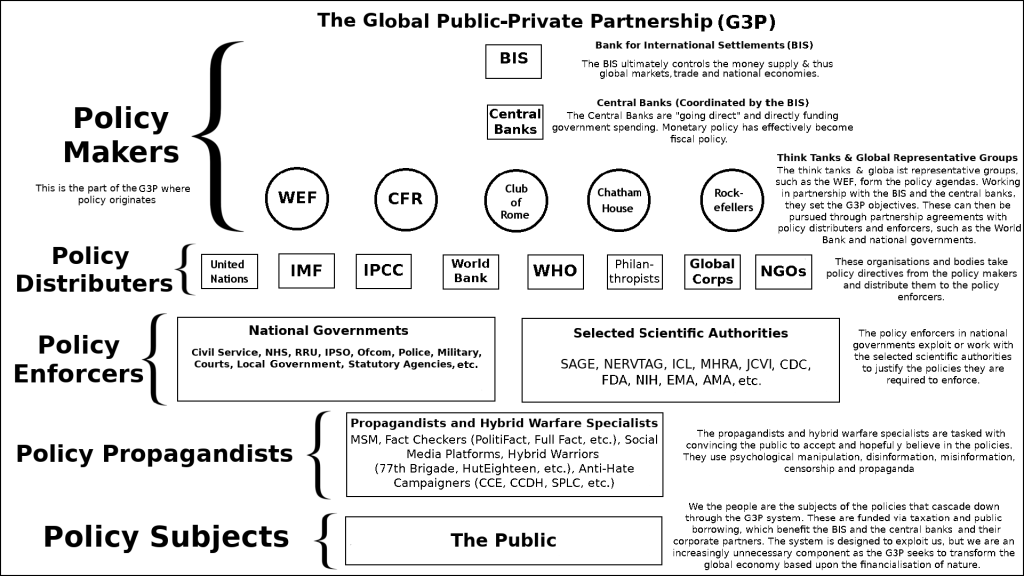

Carney is also an influential voice in the global public-private partnership (G3P), which is a worldwide network of stakeholder capitalists, many of which are global corporations. Since the G3P is a compartmentalised hierarchical structure, Carney is among the select few who enjoy more “peck rights” than most G3P members.

For instance, shortly before his SHC launch speech, Carney used the mainstream media (MSM) to signal to global corporations that they had no choice but to accept the central bankers’ “sustainable” SHC-based IMFS. If they didn’t—well, his threat was all too clear:

“Companies that don’t adapt will go bankrupt without question.”

Carney is at the centre of “net zero” financial policy-setting and yet he is simultaneously guiding many multinational investment firms to profit from the new “sustainable” IMFS that he and his fellow G20 central bankers are constructing. Few people on Earth are better placed to push for the SHC-based IMFS. And, if the plan succeeds, few have a conflict of financial interest as massive as that of Mark Carney.

The Synthetic Hegemonic Currency (SHC)

In January 2020, then-IMF Chief Economist, now-IMF Deputy Managing Director Gita Gopinath wrote an article in the Financial Times (FT) evaluating the proposed SHC:

“Some analysts suggest that the addition of private and central bank-backed digital currencies could provide the long expected but elusive shock that finally dislodges the US dollar from its decades-long dominance in global trade and finance. These technological advances could also become the ingredients for a “synthetic hegemonic currency” — a digital basket of reserve currencies — as recently proposed by outgoing Bank of England governor Mark Carney.”

Perhaps Gopinath wasn’t aware that the “elusive shock” to dislodge the USD was just around the corner? Whether in-the-know or not, she continued to describe how non-pecuniary faith in the USD was unlikely to be eroded:

“The dollar’s status is bolstered by the institutions, rule of law, and credible investor protection.”

She added that novel payment technology alone would not be enough to make an impact on the USD’s dominance. But it seems odd that Gopinath’s analysis of Carney’s speech ignored the USD spillover and spillback problems that stood as disincentives for investors.

Referencing potential reserve currency competitors, such as the Euro (€) and the Chinese renminbi (RMB – ¥), Gopinath ventured that it was difficult to see how issues like financial fragmentation, inadequate fiscal risk-sharing, weak monetary governance frameworks and long-term stability concerns could be addressed technologically.

She wrote:

“When sovereign governments, investors, and traders are confronted with digital currency choices, they are likely to reassess what currency to use for transactions across borders. Their choice will be based on many of the same factors as in the past — liquidity, stability, convertibility — but also new concerns, such as the technological superiority of the issuing country.”

Apparently, in January 2020, shortly before official declaration of the pseudopandemic, the IMF’s chief economist was either unable to grasp the proposed SHC concept or was deceiving the public. At the time, others were better attuned to the technological possibilities that have subsequently swept Gopinath’s reservations aside.

Simon Chantry, for example, is a member of the Organisation for Economic Co-operation and Development (OECD) Blockchain Expert Policy Advisory Board (BEPAB) and the World Economic Forum’s Digital Currency Governance Consortium (DCGC). In August 2020, Chantry wrote:

“[W]e can begin to imagine a future where all countries utilise national currency networks, each interconnected to facilitate exchange and trade [. . .]. While the goals of introducing CBDC networks may vary from country to country, a number of common elements apply, including the synergistic effects of having multiple CBDC networks integrated with one another despite the geopolitical and economic specifics of the countries involved.”

OECD/WEF representative Chantry described a “CBDC network” of “programmable” currency utilising some form of Distributed Ledger Technology (DLT), where the access nodes (gateways) were controlled by the central banks. Selected financial institution “partners” of the central banks would then be authorised to access the SHC system. The two-tier CBDC model, in other words.

According to Chantry, settlement of payments would be “deterministic and not probabilistic.” What this means is that all transaction data—including our personal data—would be known prior to instant settlement of payments.

The CBDC “ledger” would be maintained by each central bank. The central bank would issue the CBDC via the application programming interface (API). Private financial institutions “licensed by the central bank” would then be able to access the API to build the financial products and services that would manage CBDC transactions. As we’ve just discussed, these could be stablecoins or digital tokens, for example.

This is the basis of the global SHC. Every nation will have its own variation of CBDC, but the “common elements” will enable each national CBDC to contribute toward its own region’s “CBDC network.” These multipolar regional networks can then be “integrated with one another” regardless of “geopolitical and economic specifics.”

While the MSM preoccupy the masses with stories about apparent tensions between nation-states, the fact is, cooperation among central banks and national governments is a prerequisite for the SHC to function. Indeed, we can see that cooperation in action. If we look at the Atlantic Council’s—in other words, NATO’s—CBDC tracker, we note that “130 countries, representing 98 percent of global GDP, are exploring a CBDC.”

This unanimity is a result of the “concerted, cooperative action” Carney invoked at Jackson Hole. It is not possible for every major economy on Earth to act in tandem, developing the same monetary system simultaneously, without centralised, authoritarian control. Work on the SHC is coordinated by the BIS through its innovation hubs.

For example, the People’s Bank of China (PBC) has collaborated with the BIS through its Hong Kong innovation hub. The m-Bridge CBDC project has been developed as a potential replacement for the Society for Worldwide Interbank Financial Telecommunication (SWIFT) financial communication network.

The Atlantic Council tracker broadly shows that the BRICS nations are leading on CBDC development. While—from an “official” perspective—this is true, NATO wants us to believe that “progress on retail CBDC has stalled” in the US. For reasons we will discuss shortly, we should dispute this claim.

Is it plausible, having initially called for an SHC, that the G7 central banks are now lagging behind on its development? The evidence suggests not. They are certainly lagging behind on the rollout, but that does not imply they aren’t ready to rollout when they judge the time is right.

We have already discussed why the G7 central banks want a new IMFS and what potential benefits exist for EMEs hoping to attract investment.

However, there is another inducement for G3P policymakers that should not be overlooked. Simon Chantry explains what it is:

“A CBDC network can provide for a consolidation of elements of the financial system into a programmable currency network with all financial stakeholders playing a role in the operation and governance components.”

The SHC being a “programmable currency network” is quite the inducement. This will deliver centralised control of the IMFS and thereby of the global economy. While that control already exists to a certain extent, there is now potential for the SHC to facilitate micro-management of every aspect of international trade and commerce. Such a degree of global economic control is beyond most peoples’ imagination, but it is very real nonetheless.

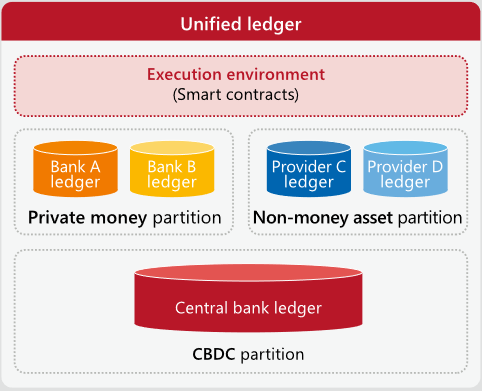

The SHC system will be operated by a network of central banks under the stewardship of the BIS. In its recent “Blueprint for the Future Money System,” the BIS elaborated:

“The key elements of the blueprint are CBDCs, tokenised deposits and other tokenised claims on financial and real assets. The blueprint envisages these elements being brought together in a new type of financial market infrastructure (FMI) — a “unified ledger”. [. . .] Through programmability and the platform’s ability to bundle transactions (“composability”), a unified ledger allows sequences of financial transactions to be automated and seamlessly integrated. [. . .] Moreover, by having “everything in one place”, a unified ledger provides a setting in which a broader array of contingent actions can be automatically executed[.] [. . .] The unified ledger thus opens the way for entirely new types of [multipolar] economic arrangement that are impossible today due to incentive and informational frictions [spillover and spillback]. [. . .] One ledger could aim at improving securities settlement, while another could facilitate trade finance in supply chains. [. . .] Some of the benefits envisaged from the unified ledger could be reaped by interlinking existing systems through APIs into a “network of networks”.”

The “network of networks,” centrally monitored and controlled through the BIS’ “unified ledger,” makes national governments’ trade or economic policies superfluous. Simply put, the BIS network of central banks and its selected “stakeholder” partners will tightly control global trade and the economy.

Even though representative democracy is not true democracy—despite what we are told—whatever semblance of democratic oversight we cling to is rendered pointless by the SHC. Indeed, national central banks will exert enormous influence in the multipolar SHC system. Yet no electorate on Earth is allowed to vote on who its central bankers will be.

National governments of major economies claim to value their alleged national sovereignty even as they willingly participate in SHC development. The idea that nation-states can maintain any meaningful “national sovereignty” under the SHC-IMFS is so absurd it borders on comical.

In October 2022, at the influential Valdai Discussion Club, Russian President Vladimir Putin emphasised all the apparent divisions between Russia and the West, but nonetheless admitted:

“Russia considers the creation of new international financial platforms inevitable; this includes international transactions. These platforms should be above national jurisdictions. They should be secure, depoliticized and automated and should not depend on any single control centre. [. . .] This will require a lot of effort. Many countries will have to pool their efforts, but it is possible. [. . .] It would make it possible to conduct effective, beneficial and secure international transactions without the dollar or any of the so-called reserve currencies. [. . .] The transition to transactions in national currencies will quickly gain momentum. This is inevitable. [. . .] Such is the logic of a sovereign economic and financial policy in a multipolar world.”

So, like Carney, it seems Putin wants to leapfrog the “second-best solution” of a basket of traditional reserve currencies and immediately install an SHC “without the dollar or any of the so-called reserve currencies.” We know it is the BIS that is “above national jurisdictions,” thus, it would seem that Putin was signalling his enthusiasm for the G7’s SHC-IMFS and an “automated” global economy managed and controlled by the BIS.

Presumably, Putin is advocating the SHC because he knows its purpose is to “build a system worthy of the diverse, multipolar global economy.” But for him to have claimed in the same speech that his government’s policy objective is to strengthen Russian “sovereignty across all areas, primarily, in the economic sphere” is ridiculous. An SHC is antithetical to national sovereignty, especially “in the economic sphere.”

The global trade and economic implications of an SHC are more than a little concerning. Are we supposed to accept that the central planning and operation of the global economy is a good idea that will benefit us?

Given the manner in which the most powerful financiers in the world have transferred wealth from us to themselves and their G3P stakeholder partners, we have no reason to believe that they intend for the proposed multipolar economy to serve our interests.

The SHC Nightmare

It is the programmability of “retail CBDC”—in whatever form it takes—that presents the greatest threat to humanity. Our adoption of retail CBDC, or programmable “tokens” on the API layer, would enable the G3P policymakers, primarily the central banks and the globalist think tanks, to control every transaction we make at the point of sale. The scope for draconian oppression of the planet’s population is virtually limitless.

Bo Li, the former Deputy Governor of the Bank of China and the current Deputy Managing Director of the International Monetary Fund (IMF), spoke at the Central Bank Digital Currencies for Financial Inclusion: Risks and Rewards symposium and explained the impact “programmability” will have on us:

“CBDC can allow government agencies and private sector players to program [CBDC] to create smart-contracts, to allow targeted policy functions. For example[,] welfare payments [. . .], consumptions coupons, [. . .] food stamps. By programming, CBDC money can be precisely targeted [to] what kind of [things] people can own, and [for what purpose] this money can be utilised. For example, [. . .] for food.”

Speaking about CBDC at the WEF Summer Davos gathering in Tianjin in the People’s Republic of China, Professor Eswar Prasad, former Chief of the Financial Studies Division at the IMF and current head of the IMF’s China division, said:

“There are huge potential gains. [. . .] You can have programmability. [. . .] Units of [CBDC] with expiry dates. You could have [. . .] potentially, a better, some people might see it, or a darker world where the government decides that units of [CBDC] can be used to purchase some things, but not other things that it deems less desirable. [. . .] That is very powerful, in terms of use of a CBDC[.] [. . .] Technology could take us to a better place, but equally take us to a pretty dark place.”

The proposed 15-minute cities, for instance, can be enforced by disabling our so-called money beyond a 15-minute radius of our homes; the purchase of certain items, ranging from vehicles to foodstuffs, can be switched off; every time we use a domestic appliance, payments to service providers, such as energy companies, can be instantaneously deducted from our accounts, as can any tax payments; travel to certain destinations can be barred by restricting ticket sales, etc.

The President of the European Central Bank (ECB), convicted financial criminal Christine Lagarde, was pranked by a comedian masquerading as the Ukrainian president. Regardless of the comedic value, Lagarde spoke candidly, as if she were speaking to Volodymyr Zelenskeyy.

Contemplating the proposed digital euro, which is being developed at considerable pace, Lagarde said:

“There will be control, you are right, you are completely right. We are considering whether for very small amounts, anything that is around 300, 400 euros, we could have a mechanism where there is zero control. But that could be dangerous.”

The fact that the ECB envisages controlling every transaction over a few hundred euros and sees “zero control” as “dangerous” tells us, in no uncertain terms that, despite Prof. Prasad’s reservations, CBDC is being designed as a comprehensive mechanism for social and behavioural control.

Brazilian software engineer and blockchain developer Pedro Magalhães proved as much when he reverse-engineered the published code for the Brazilian central bank’s proposed CBDC. He learned his country’s CBDC would be capable of freezing accounts, adjusting balances, and transferring currency between addresses, not to mention generating or eliminating digital tokens without user permission.

We need look no further than:

— to Canada for evidence that governments are willing to use financial exclusion to punish and restrict political dissent.

— to PayPal for evidence that private payment processors will withhold services to customers whose opinions they deem unacceptable.

— to crowdfunding sites that are prepared to kick dissident causes off their platforms for political reasons, regardless of the fact that they are seeking to raise money for entirely constitutional and legal purposes.

— to the financial exclusion of independent news media and journalists simply for fulfilling their duty to question power.

More recently, in the US, Dr Joseph Mercola, who has long questioned the pseudopandemic and the jabs, saw his (and his employees’) personal and business bank accounts closed without warning. Similarly, in the UK, politician-turned-political commentator Nigel Farage has been barred from accessing banking services because of his political views.

The furore over Farage’s financial exclusion elicited a response from UK Prime Minister Rishi Sunak. Sunak said it was wrong that someone should be financially excluded just for exercising their legitimate right to free speech. Yet Rishi Sunak is an avid supporter of CBDC and the SHC. His hypocrisy and obvious willingness to deceive are nauseating.

Consequently, there is reason to suspect a method behind these high-profile exclusions from the banking system. In Farage’s case, the UK government conspicuously intervened and publicly censured the banks—an unusual move, to say the least.

The UK government’s regulatory response to the very well publicised Farage case was to instruct the Financial Conduct Authority (FCA) to suggest amendments to the 2015 payment accounts regulations. These amendments will supposedly ensure that people will always have “guaranteed” access to a modern, functioning bank account.

One of the problems the rollout of the CBDC-based SHC has encountered is public reluctance to use it—that is, to “onboard.” This slow rate of “onboarding” has been a significant obstacle to the adoption of retail CBDC in countries like Nigeria. Retail CBDC bank accounts certainly won’t be “denied” to anyone. On the contrary, they could well be offered as a solution to the “problem” of apparently over-zealous commercial bank account restrictions.

If we are convinced to accept CBDC, possibly because we don’t even recognise that it is CBDC, dissidents won’t need to be controlled by restricting their access to banking services or payment providers. Maximum use of CBDC bank accounts will be encouraged. No one will be left behind.

The problem that everyone will face is that they won’t be able to use their CBDC—perhaps masquerading as programmable digital tokens or stablecoins—for any purpose that the G3P network, including their government, doesn’t “authorise.” It won’t be your access to an account but rather your account’s access to you that will be the problem.

Consider what we use our “money” for today. We might choose to invest in our own business or education. We purchase vehicles, energy, insurance and medicine. We shop for groceries and clothes. We eat out, enjoy our hobbies, pursue our interests and indulge in the pastimes we choose. We select the media (news and otherwise) we want to read, watch and listen to. As parents, we put whatever resources we can afford into our children’s future, and we alone decide what they will or will not consume during their formative years.

Now think about giving control of every one of those decisions to central bankers and their G3P “partners.” This nightmare is what the SHC portends. Politicians like Sunak and Putin are fully behind it—national and individual sovereignty be damned.

An Interlinked Network of Networks

In August 2020, only a year after Carney launched the SHC concept, Chantry described in exquisite detail the SHC system that is currently being rolled out:

“CBDC networks may be built to common international standards in order to better achieve interoperability. [. . .] [T]he proliferation of the internet and smart devices will serve to enable nations of all types to participate in the experimentation and deployment of CBDCs.”

Indeed so: Interoperability has been central to the work of the BIS innovation hubs. Interoperability will enable the SHC to make cross-border payments and develop “retail” CBDC products.

In January 2021 the BIS brought these hubs together by forming the BIS Innovation Network.

The Innovation Network’s Project Rosalind saw the BIS collaborate with the Bank of England (BoE) to develop the APIs that will, as Chantry outlined, enable private financial institution “licensed by the central bank” to access the “unified ledger” to build interoperable financial products and services. These are the same APIs that the BIS considers key to an interlinked “network of networks.”

The final Project Rosalind report, published in June 2023, stated:

“The project is based on a two-tier model representing a public-private partnership in which the central bank issues CBDC and provides the ledger infrastructure, and the private sector offers user-facing services including digital wallets.”

The “digital wallets” could, for example, contain non-fungible-tokens (NFTs) suitably programmed to “help companies meet their social responsibility commitments.” The Digital Pound Foundation, a conglomerate of stakeholder capitalists working on the development of the UK’s CBDC, stated:

“A single “system” handling both wholesale and retail CBDC certainly makes sense from a processing point of view. [. . .] By unifying the wholesale and retail CBDC, a single rich data format can be implemented, eliminating the data discrepancies that exist today across the UK payment systems. There is nothing to stop efficient scheduling of payments in one CBDC system to prioritise high value wholesale payments [. . .] including high value retail transactions, and retail settlement transactions.”

This is exactly the two-tiered “platform model” approach that numerous CBDCs are adopting. In its technical specification, the BoE outlined that its commercial “partners”—the PIPs [Payment Interface Providers] and ESIPs [External Service Interface Providers]—would be given the power to program their own digital products and services.

The BoE added that it doesn’t “currently” intend to program its CBDC directly, preferring to leave this to PIPs and ESIPs for the time being. Nonetheless, while commercial banks and payment providers will be able to control all of our transactions to their liking, the BoE stressed that the “UK CBDC must deliver the Government and Bank’s [the BoE] policy objectives.”

Not only was Chantry able to accurately predict how the SHC would operate, he was also able to outline precisely how the subsequent global rollout would proceed:

“[W]e are likely to see these networks deployed as standalone in the initial stages in order to test, analyse, and iterate on the configuration and operational elements, while not impacting the current systems. Once sufficient testing has taken place, integrations will occur incrementally, ensuring that risks are identified and mitigated where possible. Opportunities to address market problems and realise efficiency gains should be assessed and tested in full in order to understand how CBDC networks will enable the drivers of economic growth. Central banks worldwide should collaborate with their counterparts in foreign institutions to share standards, experience, and best practices as they seek the common outcome of better serving their economic stakeholders. In addition, they will discover the efficiencies to be gained from promoting interoperability between multiple CBDC networks for the purpose of cross currency exchange and multilateral settlement.”

Thus far the BIS rollout of the SHC has an unpleasant whiff of neocolonialism. While China has distributed its BIS-compliant interoperable digital renminbi (e-RMB or e-CNY) to more people than any other nation, Nigeria was the first large economy to issue a full national CBDC (eNaira).

The eNaira is a retail CBDC that uses the “two–tier” or “hybrid” model. As noted by the BIS:

“The eNaira is the Nigerian retail CBDC issued by the Central Bank of Nigeria (CBN). It was launched as the world’s second CBDC on 25 October 2021. [. . .] The eNaira uses a two-tier CBDC distribution model. The CBN administers the eNaira through the Digital Currency Management System (DCMS) to issue and mint the CBDC[,] and financial institutions maintain an eNaira Treasury Wallet for holding and managing eNaira on the DCMS [unified ledger].”

It is no coincidence that the digital pound and the digital ruble, for instance, use the same “two-tier” model. Just as Chantry correctly predicted, the BIS decided to “test, analyse, and iterate on the configuration and operational elements, while not impacting the current systems” by experimenting with CBDC in Africa first. This testing enables the BIS to identify risks and “address market problems” before fully launching the SHC in G20 countries.

So far, the “market problems” in Nigeria have been significant. The CBN strangled the supply of cash, leaving Nigerians unable to access the money they needed. This resulted in numerous protests. Nigerians have fiercely resisted the imposition of CBDC.

As the IMF notes, uptake of the eNaira has been pitiful, “falling short of one percent of active bank accounts.” The Nigerian people do not want to use CBDC and are furious about the restriction of cash.

Consequently, when it launched the digital pound, the UK government’s Treasury was quick to claim:

“A digital pound would be a new form of digital money for use by households and businesses for their everyday payments needs. As part of the wider landscape of money and payments it would sit alongside, not replace, cash [. . .]. This is in line with our ambition that public trust in money [CBDC-SHC] remains high.”

This may be technically true, but it makes no practical difference. The fact is, the SHC is designed to operate in a cashless society.

Speaking about the proposed design of the digital pound, Bank of England Deputy Governor for Financial Stability, Jon Cunliffe said:

“The digital pound would not be an anonymous bearer instrument like cash, but physical cash would remain available to those who wanted to use it. [. . .] We propose a limit of between £10,000 and £20,000 per individual as the appropriate balance between managing risks and supporting wide usability of the digital pound. A limit of £10,000 would mean that three quarters of people could receive their pay in digital pounds, while a £20,000 limit would allow almost everyone to receive their pay in digital pounds.”

Whether cash is physically available or not, if the vast majority of the working population is paid in CBDC, or a compliant “digital token,” and if all state benefits are paid the same—which is inevitable if the UK public is induced to accept CBDC of any ilk—then the UK will be a cashless society, totally reliant upon CBDC products and services, within a matter of months.

So what are we to make of Chantry’s remarkable prescience? There is no suggestion that he has the authority to manipulate the IMFS. Such power is reserved for people like Carney and his high-ranked G3P “stakeholder” colleagues. But what Chantry’s observations reveal is that those working behind the scenes on the CBDC-SHC understood the objectives and were appraised of the trajectory years ago.

There are no significant technical barriers to inhibit the SHC rollout. Public objections are the problem the G3P policymakers need to overcome.

A prime example of pushback is Switzerland. The Swiss people have gathered enough signatures to compel their government to hold a referendum on a proposal to add a clause to Swiss law that will guarantee the ongoing availability of cash. Unfortunately, even if the Swiss citizens who wish to retain cash win that vote, their government is under no obligation to abide by the outcome.

The comments of the BoE’s Cunliffe and the UK government’s regulatory “response” to the Farage debacle suggest that even if the public is permitted to keep cash, governments—that is, G3P stakeholder partners—already have coercive and deceptive solutions in mind.

The ability of private financial institutions to offer digital tokens, stablecoins and NFTs, etc. that utilise the central banks’ API layers, makes it entirely feasible that the public could be lulled into using retail CBDC without their knowledge. Thus averting their objections.

The Incredibly Lucky Synthetic Hegemonic Currency

In June 2023, IMF Managing Director Kristalina Georgieva addressed the Moroccan Central Bank (Bank Al-Maghrib) conference on Central Bank Digital Currencies. She told the gathered delegates:

“We used to say, before the pandemic, that the future is digital. With the pandemic, the future arrived. We now have an accelerated transformation[.] [. . .] [I]f we don’t move fast, as policy makers, we risk [missing] an opportunity. [. . .] We have seen many central banks picking up on the issue of CBDCs[.] [. . .] [T]he largest pilot in the world is in China. [. . .] If we are to be successful, CBDC [must] not be [a] fragmented national proposition. [. . .] We need systems that connect countries. In other words, we need interoperability. For this reason, at the IMF, we are working hard on a global CBDC platform.”

Georgieva correctly referred to herself and her fellow central bankers as “policy makers.” Most central banks are independent from government and have the power to make monetary policy. This authority already affords them considerable control over economic activity. Thus, to a great extent, control of government fiscal policy is also possible.

The great advantage of CBDC is that it will enable nation-states to enforce central bankers policy decisions without the need for any corresponding legislation. The central bankers can move beyond monetary policy setting into every policy area. The G3P will effectively capture the entire political process in every country that adopts a CBDC-SHC.

At the same Bank Al-Maghrib conference, IMF Director of the Monetary and Capital Markets Tobias Adrian outlined the global CBDC platform in more detail. Alleging that digitisation would “improve money,” he presented a “blueprint” for the proposed “infrastructure behind money.” It is evident from Adrian’s remarks that Carney’s call for “concerted, cooperative action” has been heeded:

“[T]he international community is enhancing cross-border payments following the G20’s 2020 Roadmap. More than ever, the IMF, World Bank, BIS, and FSB have been tightly collaborating, each bringing its comparative advantage to the table. [. . .] Platforms are like digital town squares where people and businesses meet to transact under the watchful eye of the local authorities. [. . .] Expressed in today’s language, the vision is for a trusted ledger[.] [. . .] [O]ur trusted ledger cannot exist in a vacuum. It must exist in an environment allowing for basic financial contracts to be customized and exchanged in a safe and efficient manner. And it must allow information to be carefully managed—so only those who need it can see it.”

This plan appears to be synonymous with the BIS’s “unified ledger.” Its identical purpose is to facilitate international transactions “under the watchful eye” of licensed “authorities.”

Adrian described how the IMF’s global CBDC platform would facilitate the “two-tiered” program model favoured by most national CBDC projects. The automated cross-border transactions Putin advocates can be programmed off-ledger by multinational corporation “partners,” such as PIPs and ESIPs in the UK, for example.

The IMF’s global CBDC platform is an international exchange (XC) ledger enabling cross-border transactions in CBDCs. It is a “network of networks” essential for the operation of the global SHC.

Carney’s call for an SHC to address investors USD-related “unhedged risks” has paved the way for subsequent CBDC development. Again, addressing the Summer Davos in China, Prof. Prasad said:

“The one element where there is clearly strong user cases [is] that of wholesale CBDCs, or multiple CBDC bridges, that allow for more efficient cross-border payments . [. . .] This is going to have tremendous benefits, in terms of cross-border payments being settled instantaneously, reducing the need for hedging. It’s going to make it much easier for economic migrants, sending remittances back to their home countries. The number of central banks around the world engaged in these initiatives to integrate their wholesale CBDCs and this is going to have real benefits in terms of trade and financial transactions.”

Remember, just three years earlier Gita Gopinath had said that an SHC “digital basket of reserve currencies” would not be adopted because investors and financiers had non-pecuniary faith in the USD “bolstered by the institutions, rule of law, and credible investor protection.” She had added that only some “elusive shock” would finally dislodge “the US dollar from its decades-long dominance.”

Mark Carney apparently agreed with her at the time. Back in August 2019, he had alluded to the creative destruction that was needed:

“[K]eeping one’s house in order is no longer sufficient. The neighbourhood too must change.”

It is therefore quite remarkable—suspicious, even—that global events have seemingly conspired to move the SHC from the G7 bankers wish list to being the basis for a new IMFS in the space of a few short years. The “elusive shock” appears to have arrived right on cue with the pseudopandemic. Kristalina Georgieva correctly observed: “With the pandemic, the future arrived. We now have an accelerated transformation.”

Let’s look at the timeline. The WHO declared a “global pandemic” on 11th March 2020. At the behest of the G20, the BIS-hosted Financial Stability Board (FSB) issued its Stage 1 Report on enhanced cross-border payments a month later—on 9th April 2020. Clearly the FSB had been working on that plan for some months prior to publication.

The Committee on Payments and Market Infrastructures (CPMI) is a standard-setting body of the FSB. Building upon the Stage 1 Report, the CPMI was doing detailed work on the SHC in preparation for the July 2020 publication of its Stage 2 building blocks for a global cross-border payment system.

The chair of the FSB at the time was Randal Quarles, who was also the first US government-appointed vice chair for supervision of the Federal Reserve (the Fed). The CPMI Stage 2 report declared:

“[While] the economic ramifications of the Covid-19 pandemic are undoubtedly [. . .] affecting the payments landscape in the short term, it is important to maintain momentum to identify and take forward structural improvements in cross-border payment arrangements for the post-pandemic global economy. [. . .] Recent advances in technology and innovation have created the potential for new payment infrastructures and arrangements that could be applied to cross-border payments. [. . .] The building blocks in this focus area are aimed at exploring the potential that new multilateral cross-border payment platforms and arrangements, central bank digital currencies (CBDCs) and so-called global “stablecoins” could offer for enhancing cross-border payments.”

The Stage 2 report led to the FSB’s October 2021 publication of the G20 Roadmap for Enhancing Cross-border Payments. This Roadmap was a “priority initiative of the G20.” The Roadmap report noted:

“The success of this work will depend heavily on the commitment of public authorities and the private sector, working together. [. . .] In order to achieve progress in a timely manner to meet the targets, the public and private sector will need to begin their planning and budgeting for the needed enhancements very soon.”

It added:

“[C]entral banks recognize that the implications of CBDCs go well beyond national borders, highlighting the need for multilateral collaboration on macro-financial questions and the importance of interoperability between CBDCs. [. . .] The CPMI in collaboration with the BIS Innovation Hub, IMF and World Bank conducted a stock-take of provisional domestic CBDC designs and central bank experimentation to determine to which extent they could be used for cross-border payments. Central banks have started collaborating on several projects and studies to consider internationally coordinated CBDC arrangements to enhance cross-border payments.”

All of this work was justified and triggered by the alleged “economic ramifications of the Covid-19 pandemic.” For those who wish to impose the SHC, the so-called pandemic was an incredibly lucky opportunity that they quickly seized.

Running parallel with this global SHC development effort was the G7 central banks’ deployment of “going direct” QE, which caused the price inflation they now largely blame on the pandemic and the Ukraine war. Going direct QE coincidentally created the economic instability conducive to the introduction of the SHC.

In response to the Russian government’s highly unusual “Special Military Operation” (SMO) in Ukraine, the governments of the United States, the United Kingdom, Canada, France, Germany, Italy, and the European Commission together seized $630 billion of Russia’s foreign currency reserves in February 2022. Many economists quickly realised what this move signified.

Macroeconomist Philip Pilkington was one. In March 2022, he wrote in American Affairs:

“This action could mark a tectonic shift in the global monetary system comparable to the U.S. dollar breaking its peg to gold in 1971. [. . .] Reserve currencies, like all currencies, rely for their value on trust[.] [. . .] [A] holder of a reserve currency must be confident that the asset will not simply be seized. If a country thinks that the country issuing the reserve currency might simply seize it—especially at a time when it is most needed—then it would be unwise to hold this reserve currency if there are alternatives on the table. Seizing reserves is a trivial exercise in technical terms, [. . .] but until now few countries have been willing to weaponize it on such a large scale.”

The so-called “rule of law” means nothing if the issuer of the reserve currency is willing to simply seize another nation’s reserves whenever it disapproves of that country’s policies or actions. Vladimir Putin was in part right to observe:

“Imposing sanctions is the logical continuation and the distillation of the irresponsible and short-sighted policy of the US and EU countries’ governments and central banks. [. . . ] The global economy and global trade as a whole have suffered a major blow, as did trust in the US dollar as the main reserve currency. The illegitimate freezing of some of the currency reserves of the Bank of Russia marks the end of the reliability of so-called first-class assets. [. . .] Now everybody knows that financial reserves can simply be stolen.”

Was US/EU policy really “irresponsible and short-sighted”? The sanctions washed away the other stumbling block for global acceptance of an SHC: investors’ non-pecuniary faith in the USD underpinned by the “rule of law.” Once again, this was incredibly fortunate for SHC enthusiasts!

Prior to Russia’s launch of its SMO in Ukraine, in June 2021 the governor of the CBR, Elvira Nabiullina, said that the CBR was focused on developing cross-border payments using CBDC. Citing the pseudopandemic as the driver for the Russian transformation, Nabiullina acknowledged both that the CBR held considerable foreign reserves and that sanctions were a “persistent threat.”

When the Russian Federation government launched its military campaign, Kremlin spokesman Dmitry Peskov said the Russian government was fully prepared for the inevitable sanction response. Yet, for some reason, the preparations didn’t include taking any steps to protect $630 billion of foreign reserves from seizure. Had it taken the seemingly obvious precautionary measure, the US-led sanctions wouldn’t have been able to undermine the international monetary “rule of law” in such spectacular fashion.

The reserve sanctions were combined with G7-aligned nation-states’ decision to progressively cut Russian commercial banks out of the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network. While the Western mainstream media was parroting the politicians’ lies that the whole world was united against Russia, in reality national governments around the world were not eager to condemn Russian actions.

The West’s collective reserve seizure and the SWIFT sanctions against the Russian government—especially US involvement in these actions—seemingly made no sense whatsoever. While the USD remained the dominant global reserve currency, the Fed could digitally “magic” the dollar into existence in order to easily finance US trade and budget deficits. By contrast, other countries, such as China, were forced to purchase USDs and faced additional costs.

This gave the US what former French President Valéry Giscard d’Estaing called an “exorbitant privilege.” Maintaining the USD as the dominant global reserve currency afforded the US economy a considerable competitive advantage.

The decision to throw all this away looks even weirder when you also consider that the Russian and Chinese governments, in particular, had long sought to “de-dollarise” their economies. They had already formed numerous bilateral trade agreements outside of the USD system. In addition, both countries were eager to promote their own alternatives to the SWIFT transaction telecommunication system.

The West handed the Russian Federation and Chinese governments a massive boost toward achieving some of their most sought-after monetary and foreign policy objectives. In doing so, the US government also undermined its own “exorbitant privilege.”

This is all very perplexing until you realise that the objective is to establish an SHC fit for a multipolar global economy. Seen in this light, the seemingly inexplicable seizure of Russian reserves, the confounding attack on the SWIFT system and the blatant weaponisation of the IMFS all become insidiously rational.

The Synthetic Hegemonic Currency Is Imminent

The original term for the BRIC(S) group of nations (Brazil, Russia, India and China)—the “S” was added when South Africa joined in 2010—was first coined in a 2001 White Paper by the Goldman Sachs Economic Research Group led by economist and Chatham House fellow Jim O’Neill. The Goldman Sachs team correctly identified that “real GDP growth in large emerging market economies [EMEs] will exceed that of the G7.”

The BRICS surpassed G7 “growth” and have now eclipsed the G7 in terms of global GDP share, measured in Purchasing Power Parities (PPPs). The PPP is the measure favoured by the IMF and the OECD. The World Bank uses market-based rates in its GDP calculations. Using PPP is more accurate, but data collection is harder because it is based upon a global survey of prices.

According to market exchange rate calculations, preferred by the World Bank, the US remains the world’s largest single national economy. However, based upon PPP, China overtook the US some years ago. Irrespective of the technical debate, there is no doubt where current global economic growth is found.

In April 2023, The Times of India reported:

“[W]hile the share of GDP of G7 nations based on PPP [was] reduced from 50.42% of the World’s GDP in 1982 to 30.39% in 2022, the share of GDP of BRICS nations increased from 10.66% in 1982 to 31.59% in 2022. [. . .] The CAGR [compound annual growth rate] of BRICS GDP in World’s GDP from 1982 to 2022 is rising at 2.75% per year, that of G7 is falling at -1.26% per year.”

This explains the G7 bankers’ eagerness. The dominance of the USD inhibits investors’ access to the EMEs.

Simply from an economic perspective, an SHC is an enticing prospect for the G3P. Around 95% of all cross-border payments are business-to-business (b2b) transactions. Nearly all of this business is facilitated by central and commercial banks, and the global value of that trade stood at an estimated $156 trillion in 2022. With an SHC in place, central banks and their G3P financial partners will have programmable control of the world’s b2b transactions. This will afford them both immense profits and global power,.

G7 nations have put a lot of time and effort into supporting the rise of China’s economy, an SHC is now required to maximise investment opportunities as China’s—and with it the BRICS’—economic star rises. The game had to change, and the “shocks” wrought by the pseudopandemic and the Ukraine conflict, supposedly justified the policy response that changed it.

Russia is the third–largest oil-producing nation after the US and Saudi Arabia and the second–largest producer of natural gas after the US. But US domestic energy consumption far exceeds Russia’s. Consequently, Russia is the second–largest oil exporter, after Saudi Arabia, and the leading natural gas exporter in the world. Russia also possesses the largest gas reserves on Earth.

The imposition of sanctions by the West not only undermined global confidence in the USD as a stable reserve currency, it also started to realign global trade. By March 2022, even Gita Gonipath—by then having risen to the post of IMF Deputy Director—was publicly expressing doubt about the USD. Though she still maintained that the USD would remain dominant, she conceded:

“The dollar would remain the major global currency even in that landscape but fragmentation at a smaller level is certainly quite possible. [. . .] We are already seeing that with some countries renegotiating the currency in which they get paid for trade.”

Western MSM propaganda outlets openly admitted that Russia oil exports were increasingly flowing to Russia’s BRICS partners. Most notable was the deepening investment, trade and economic relationship between Russia and China. Thomas Duesterberg, a member of numerous globalist think tanks, called the realignment of energy flows from Russia, especially to China and India, an “historic shift.”

Prior to the increased sanctions, the Russian Central Bank (CBR), supported by the government, was leading the development of cross-border payment using digital currencies. In 2019 the head of the Russian Direct Investment Fund (RDIF) Kirill Dmitriev proposed that the BRICS should develop a system of cross-border payments using digital currencies.

Subsequent interoperable CBDC development by BRICS nations has made this a more realistic proposition. The prospect of a BRICS SHC was bolstered by the CBR’s pilot of cross-border settlements in CBDC. The head of the Russian Financial Innovations Association (AFI) Roman Prokhorov signalled that China was a likely pilot participant.

Like its G7 central bank counterparts and Vladimir Putin, the People’s Bank of China (PBOC) does not wish to adopt the “second-best solution” of a basket of traditional currencies for cross-border payments. The PBOC released a white paper in July 2021 stating that the e-CNY is “ready for cross-border use”:

“[T]he PBOC will actively respond to initiatives of G20 and other international organizations on improving cross-border payments, and explore the applicability of CBDC in cross-border use cases. [. . .] The PBOC will explore pilot cross-border payment programs and will work with relevant central banks and monetary authorities to set up exchange arrangements and regulatory cooperation mechanisms on digital fiat currency in line with the principles of “no disruption,” “compliance,” and “interoperability”.”

As previously mentioned, the PBOC has not undertaken this work in isolation. It is part of the BIS’ mBridge project designed to make all CBDCs interoperable for cross-border payments.

Calling the SHC a “multi-CBDC,” the BIS said:

“Multiple CBDC (multi-CBDC) arrangements that directly connect jurisdictional digital currencies in a single common technical infrastructure offer significant potential to improve the current system and allow cross-border payments to be immediate [. . .]. A platform based on a new blockchain — the mBridge Ledger — was built by central banks to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs. [. . .] mBridge demonstrates that it is realistic to aim for a tailored multi-CBDC platform solution to tackle the limitations of today’s cross-border payment systems.”

Olga Skorobogatova, First Deputy Chairman of the Russian Central Bank, discussed the digital ruble’s interoperability with other CBDCs. She noted that the hurdles were not technological but rather political:

“All organizational and technological issues can be resolved if political consensus is reached. [. . .] If there are such agreements, then the integration of national digital currencies can really replace SWIFT, because payments and information on them will take place in a completely different settlement infrastructure than now.”

Emphasising Russian enthusiasm for a BRICS SHC, Skorobogatova added:

“A common digital currency for the BRICS countries could be a breakthrough, a significant simplification of settlements between our economies. [. . .] Therefore, we participate in working groups and work in parallel with every country that is ready to cooperate with us on the integration of digital currencies.”

With a view to establishing a “regionalised” CBDC-based SHC, Skorobogatova highlighted how the CBR had opted for a CBDC model that was interoperable with the PBOC’s e-CNY:

“[T]he experience of our Chinese colleagues is also extremely indicative for us. [. . .] China used a hybrid [two-tiered] architecture — a combination of centralized solutions and blockchain elements. We empirically came to the same conclusion. [. . .] The digital ruble will eventually take its place in the financial infrastructure.”

A “regionalised” SHC is now an imminent prospect. Similarly, development of the “tailored multi-CBDC platform” hosted on the BIS “unified ledger” can create “the” global SHC with relative technological ease. All obstacles are now political.

In June 2022, as a direct result of the sanctions, the BRICS announced their plans to establish a new form of global reserve asset based on a basket of BRICS currencies. The chairman of Russia’s State Duma, Alexander Babakov, said that Russia was leading on the initiative.

As reported by the Carnegie Endowment for International Peace (CEIP), with China, India and other EMEs, such as Indonesia and the Philippines, equally keen on CBDC cross-border settlement, the BRICS “basket” looks likely to be the world’s first SHC.

The US Is Not “lagging Behind”

NATO’s Atlantic Council wants us to believe that the leading G7 nation, the US, is lagging behind. This is propaganda intended for a population that is highly sceptical of CBDC.

By November 2022 the US CBDC was already at the pilot stage. Adopting the standard “two-tiered” model, it was fully tested as “an interoperable network of central bank wholesale digital money and commercial bank digital money operating on a shared multi-entity distributed ledger.” As part of its work developing the global interoperable “network of networks” (SHC), the Fed pilot was run by the BIS’s New York Innovation Center (hub).

Last month (July 2023), the Fed officially launched its instant interbank payment system, called FedNow. The Fed has been at pains to stress that FedNow has nothing to do with its functioning “hybrid” CBDC and that it is purely designed for domestic payments. This is not true.

FedNow is a “fast payment system” (FPS). It is essentially a technological upgrade of existing US interbank settlement systems. It enables transactions to be completed almost instantaneously as real-time payments (RTPs).

Prior to the FedNow launch, in its report on the future monetary system, the BIS pointed out that CBDC and FPS exist on a digital monetary “continuum:”

“Both retail CBDCs and FPS allow for instant payments between end users, through a range of interfaces and competing private PSPs [payment service providers]. They hence build on the two-tiered system of the central bank and private PSPs. Retail CBDCs and FPS share a number of further key features and can thus be seen as lying on a continuum. Both are supported by a data architecture with digital identification and APIs that enable secure data exchange. [. . .] New private applications will be able to run not [only] on stablecoins, but on superior technological representations of M0 [the total amount of circulating notes and coins plus commercial banks operational balances with central banks] – such as wholesale and retail CBDCs, and through retail FPS that settle on the central bank balance sheet. [. . .] Wholesale and retail CBDCs, FPS and further reforms in open banking show how central banks can support interoperability and data governance. [. . .] Over 60 jurisdictions now have retail fast payment systems, with several more planned in the coming years – such as FedNow in 2023.”

With regard to the “further reforms in open banking,” among other innovations, the BIS is referring to the use of commercial financial institutions’ digital products, such as digital tokens:

“Tokenised deposits are a digital representation of commercial bank deposits on a [permissioned distributed ledger technology] DLT platform. They would represent a claim on the depositor’s commercial bank, just as a regular deposit does, and be convertible into central bank money (either cash or retail CBDC) at par value. [. . .]. Crucially, this could be done in a regulated system, with settlements in wholesale CBDC.”

Like JPMorgan’s “deposit tokens,” FedNow is not a CBDC, but it is fully interoperable with CBDCs. In addition, the Fed has a two-tier CBDC ready and waiting. When the US CBDC is officially launched, all “approved” US digital money, such as JPMorgan’s “tokenised deposits,” will be “convertible into central bank money” (CBDC). FedNow already enables “settlements in wholesale CBDC.” All that is needed now is the political will to set the system in motion.

The Fed’s desire to obfuscate FedNow’s true purpose is clear. In its FedNow FAQs it avers:

“At launch, the FedNow Service will support only domestic payments between U.S. depository institutions.”

“At launch” is the operative term in this statement. Nick Stanescu, a Fed senior vice president, led on the development of FedNow. Speaking in March 2023 he said that the Fed was planning to use FedNow for cross-border payments:

“[FedNow] could support instant payments, not just in the U.S., but also for cross-border types of use cases. [. . .] July is just the beginning.”

The ISO 20022 transaction communication standard is a key feature for CBDC interoperability at the interbank settlement layer. The “G20 Roadmap” advocates adoption of “a harmonized ISO 20022 version” as a crucial step toward “interlinking payment systems.”

Since 2011, the PBOC and the Chinese government have led the way on global adoption of the ISO 20022 standard. China’s Cross-border Interbank Payments System (CIPS) is also based upon ISO 20022 standards.

The European Central Bank (ECB) migrated to ISO 20022 in 2021, and the same year the BIS noted “the message standard (eg ISO 20022) [. . .] would act to harmonise standards across systems.” ISO 20022 migration is a global initiative. The SWIFT payment messaging system moved to ISO 20022 standardisation in March 2022.

In the same month (March 2022), Stanescu revealed that FedNow is also ISO 20022 compliant: